Carrier Global Q1’24 Earnings

Results

Source: Koyfin (affiliate link with a 20% discount for StockOpine readers, premium members can benefit from a 3-month free trial), StockOpine Analysis

Revenue for Q1’24 was up 17% compared to Q1’23, with organic sales up 2%, and Viessmann Climate Solutions (“VCS”) contributing to the inorganic growth.

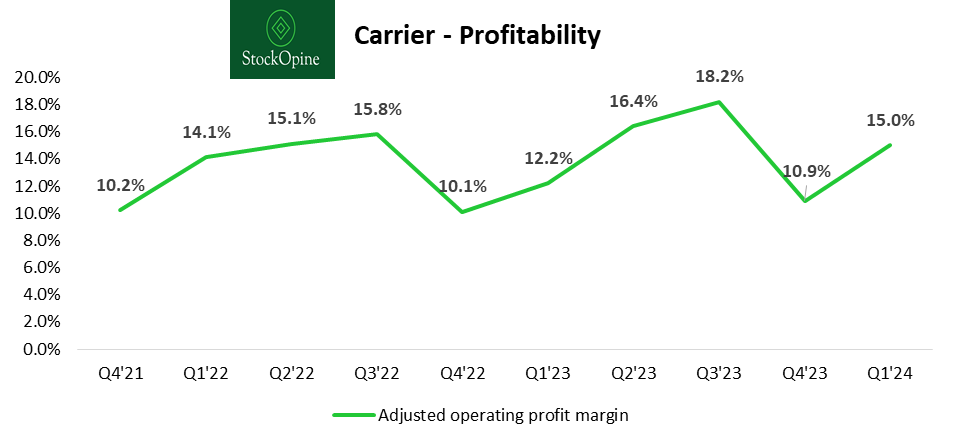

Adjusted operating margin was 15% compared to 12.2% in prior year, driven by improved operating margins in HVAC and Fire & Security segments, with improvement coming from price increases and productivity. This is despite 50 basis point dilutive impact from VCS.

Source: Carrier Earnings Releases, Stockopine analysis

HVAC accounted for 73.4% of sales compared to 68.7% in prior year. With greater concentration in HVAC, Carrier aims to further expand operating margin.

Outlook

Carrier maintained its full-year 2024 adjusted EPS guidance range and increased its adjusted operating margin guidance to 15.5%.

Source: Carrier Earnings Presentation Q1’24

HVAC

HVAC segment experienced organic sales growth of 2%, accelerating from -1% sales growth in Q4’23. HVAC sales in the Americas were up mid-single digits, driven by strength in commercial and light commercial HVAC with each being up approximately 20%.

This was offset by North America residential HVAC sales which were down low-single digits. This is a significant improvement from the high twenties volume decline experienced in Q4’23 when distributors were cutting down on orders. On a positive note, North America residential orders had a second consecutive quarter of year-over-year growth. Management expects volume to increase year-over-year in each of the remaining quarters, reflecting the recovery of HVAC residential.

Operating margin was 15.9%, compared to 13.5% in prior year even though VCS negatively impacted margin by about 80 basis points. Management expects FY24 full year HVAC segment margin to be about 17.5%, compared to 16.6% in FY23.

Fire & Security

Fire & Security performed phenomenally well, with sales up 7% organically in the quarter. Both commercial and residential fire sales were up mid-single digits.

Adjusted operating margin for the segment was 18.5% compared to 12.4% in prior year due to strong volume growth and productivity efficiencies.

Announced sales of Access Solutions and Industrial Fire segments are expected to close in Q3’24. Residential and Commercial Fire sale is targeted to be completed by the end of this year.

Refrigeration

Refrigeration segment had a mixed performance with a 2% decline in organic sales.

Within transport, container was up over 50% year-over-year with the recovery continuing from Q4’23. Global truck and trailer was down low teens, driven by North America truck and trailer which was down 25%, due to lower demand, channel destocking and strong prior year comps (up 40% in Q1’23).

The segment is expected to be up by low-single digits in 2024 organically, indicating recovery during the remaining of the year. This is demonstrated by North America truck and trailer orders which were up 50% year-over-year during the quarter.

Adjusted operating margin for the segment was 11.2% compared to 12.4% in prior year. The adjusted operating margin for the Refrigeration segment was down during the quarter primarily due to the absence of a $24 million gain related to a sale in Q1’23. Excluding this gain, the adjusted operating margin for the quarter was up 150 basis points year-over-year, driven by price and productivity improvements.

Viessmann Climate Solutions (VCS)

The company closed the acquisition of VCS.

VCS sales were down 12% in the first quarter, driven by lower solar PV sales, while the company expects revenue to rebound in the second half of the year. The full-year forecast for VCS is flat to down 5% which is lower than the mid-single digit growth anticipated in February guidance.

VCS underperformance is driven by pullback in demand for solar in EU. Chinese manufacturers flooding the EU solar market could have also contributed in the decline. VCS expects solar PV sales to be down approximately 30% for the year.

Aftermarket

6% increase in aftermarket sales, led by double-digit growth in commercial HVAC.

The company remains committed to its goal of achieving $7 billion in aftermarket revenues by 2026, despite the $500 million of aftermarket sales that will be divested through the business exits. To reach target it plans to drive a low-double-digit CAGR. Aftermarket sales for FY23 were $5.5 billion, therefore aftermarket sales should grow at approximately 8% CAGR to reach their target.

Data center opportunity

The AI shift affects Carrier as well since AI chips require more cooling than traditional chips.

“The AI movement is driving hyper and sustained growth in this space, not only driving data center growth, but also an outsized opportunity for cooling providers, given that AI chips drive 7x the heat generation versus traditional chips. Today, AI makes up about 20% of the load of a typical data center, and some of our customers project that percentage to increase to 80% in the next few years, thus parting huge demand on the grid and increasing the need for differentiated HVAC and control solutions." David Gitlin, CEO

The data center market for the HVAC business is projected to increase from roughly $7 billion in 2023 to $15 billion-$20 billion in 2027, reflecting a CAGR of 7.5%. This vertical represents a low double-digit percentage of Carrier’s global commercial HVAC business, and management plans to increase this segment to well over 20% in the future.

Thoughts

Carrier delivered a robust quarter, notably excelling in operating profit margin expansion. The revised target of 15.5% operating margin for FY24 surpasses the 15.1% operating margin we factored into our valuation model in May 2023. We are pleased to see the encouraging signs in North America's HVAC residential sector suggesting revenue acceleration during the year, however, the underperformance of Viessmann Climate Solutions is concerning. Nonetheless, it seems to be driven by broader market dynamics rather than company-specific issues.