Valuation Update: Toast ($TOST)

Stellar execution, but is the valuation reasonable?

1. Company Introduction

Toast, Inc. (TOST 0.00%↑) is a cloud-based, all-in-one digital technology platform built specifically for the restaurant community. It provides a comprehensive suite of SaaS products and financial technology solutions, including point-of-sale, payment processing, operations management, and marketing tools, serving as the central operating system for its clients.

This article is just a valuation update as it was requested by our premium members. For a more detailed background on the company's business model and competitive landscape, please refer to our March 2024 deep dive, ‘Raising a Toast: The Path to Profitability.’

2. A Story of Consistent Execution

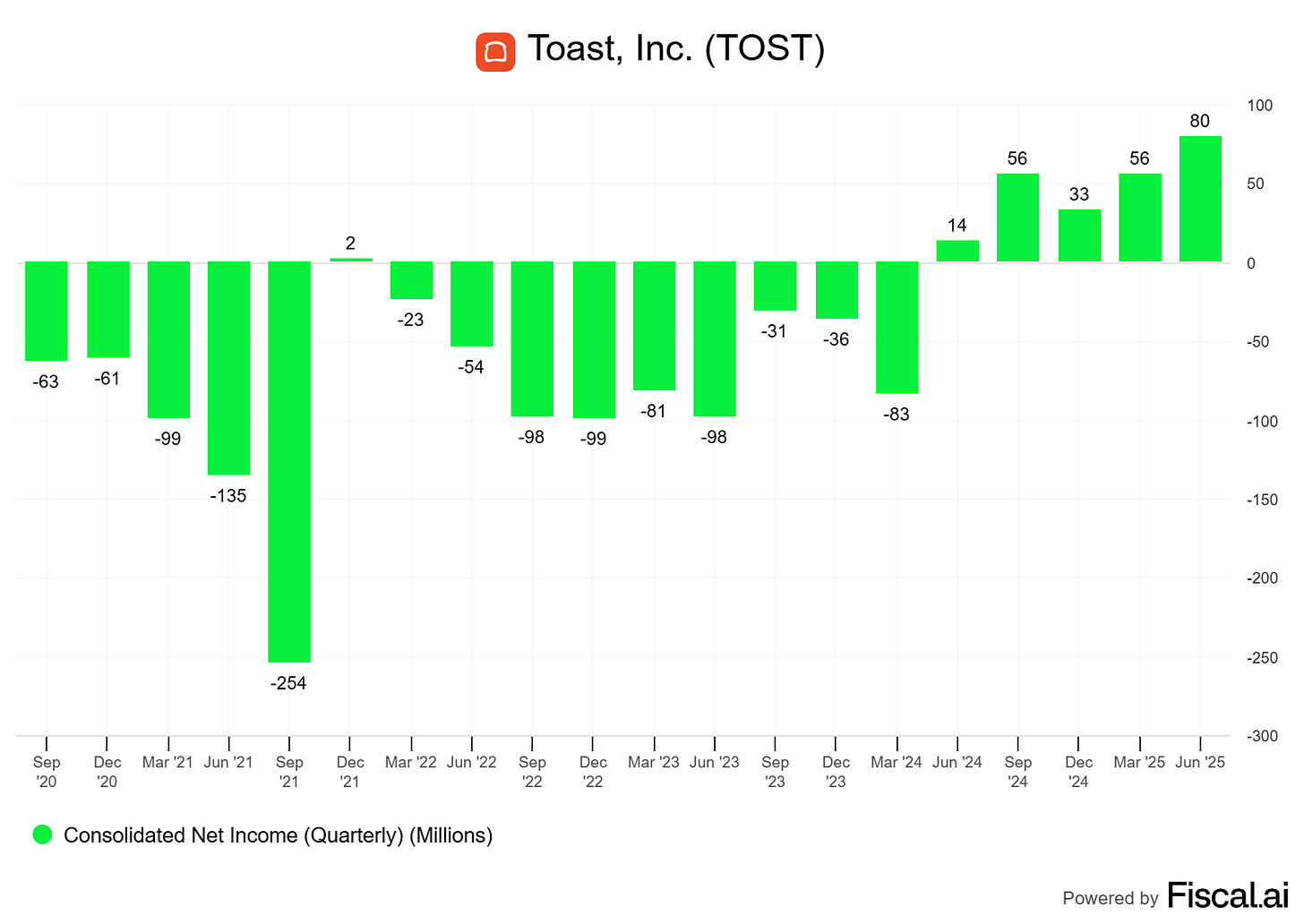

Toast's recent performance has been defined by significant momentum and accelerating profitability, beginning with a transformational 2024. The company achieved its first full year of GAAP profitability with $19 million in net income and adjusted EBITDA of $373 million (7.5% of total revenue), while it added a record 28,000 net locations, ending the year with approximately 134,000, marking a 26% increase.

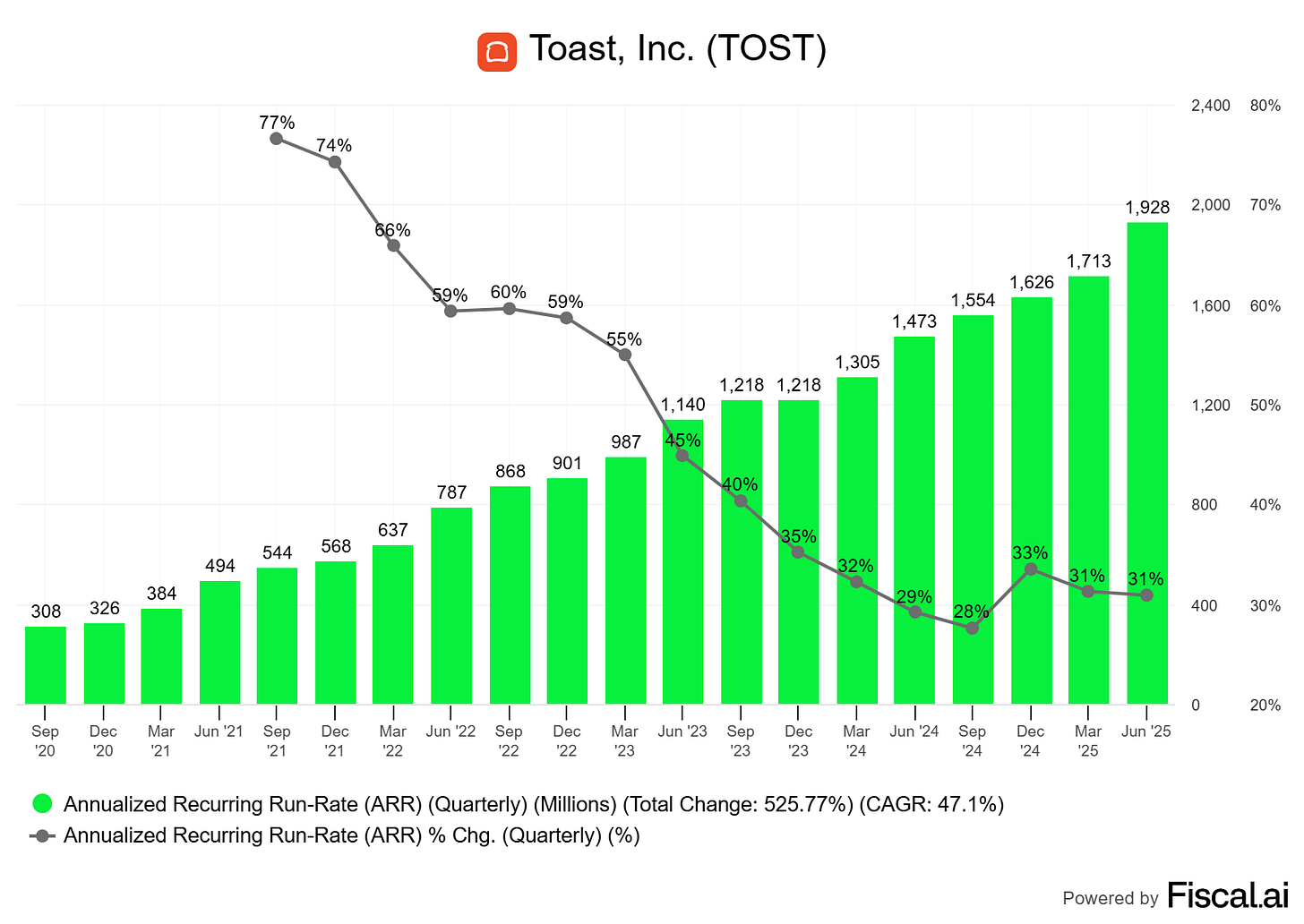

This momentum continued into the first half of 2025, where the company consistently exceeded expectations. Across the first two quarters, Toast added over 14,500 net new locations, including a record 8,500 in the second quarter alone, bringing its total to approximately 148,000 locations. During this period, Annualized Recurring Run-Rate (ARR) grew 31% to reach $1.9 billion. ARR is split between Payments ARR of $978 million (+32% YoY) and Subscription ARR of $950 million (+30% YoY).

Source: Fiscal.ai (affiliate link with a 15% discount for StockOpine readers)

Growth was bolstered by significant wins in new markets. Toast secured its largest-ever deal with Applebee's, expanded into its fourth international market with a launch in Australia, and surpassed 10,000 cumulative live locations across its enterprise, international, and F&B retail segments.

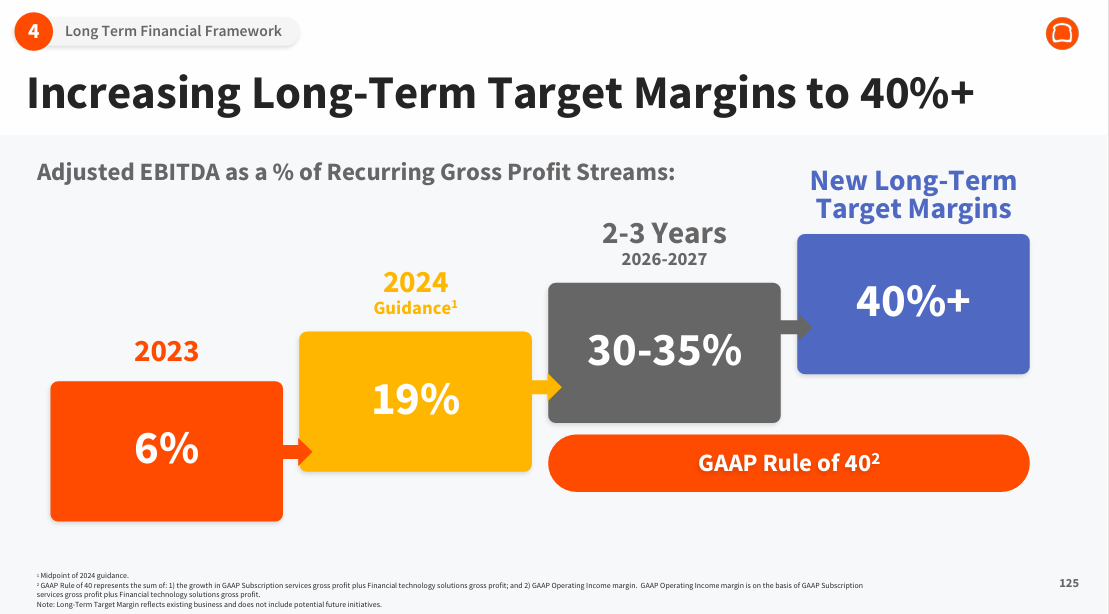

This strong execution drove profitability well ahead of schedule. The company surpassed its medium-term Adjusted EBITDA margin targets (30-35% of recurring gross profit) in the first quarter at 32% and hit ~35% in Q2. Consequently, management raised its full-year 2025 Adjusted EBITDA guidance twice in two quarters: from an initial range of $510-$530 million to a revised $565-$585 million, representing about 31.5% Adjusted EBITDA margin of recurring gross profit.

This performance supports the long-term strategy outlined at the 2024 Investor Day. Management significantly expanded its view of the Total Addressable Market (TAM) to 1.4 million locations globally, a ~60% increase since the IPO, by including international and Food & Beverage retail opportunities. This larger target demonstrates the company's long runway for growth, as it currently holds approximately 15% market share by payment volume in the US restaurant market. At the Investor Day, management also established a new long-term Adjusted EBITDA margin target of 40%+.

Source: 2024 Toast Investor Day Presentation

Current Financials & KPI Snapshot (as of Q2 2025)

Total Locations: ~148,000, up 24% YoY

Total Revenue: $1.55 billion, up 25% YoY

Annualized Recurring Run-Rate (ARR): $1.9 billion, up 31% YoY

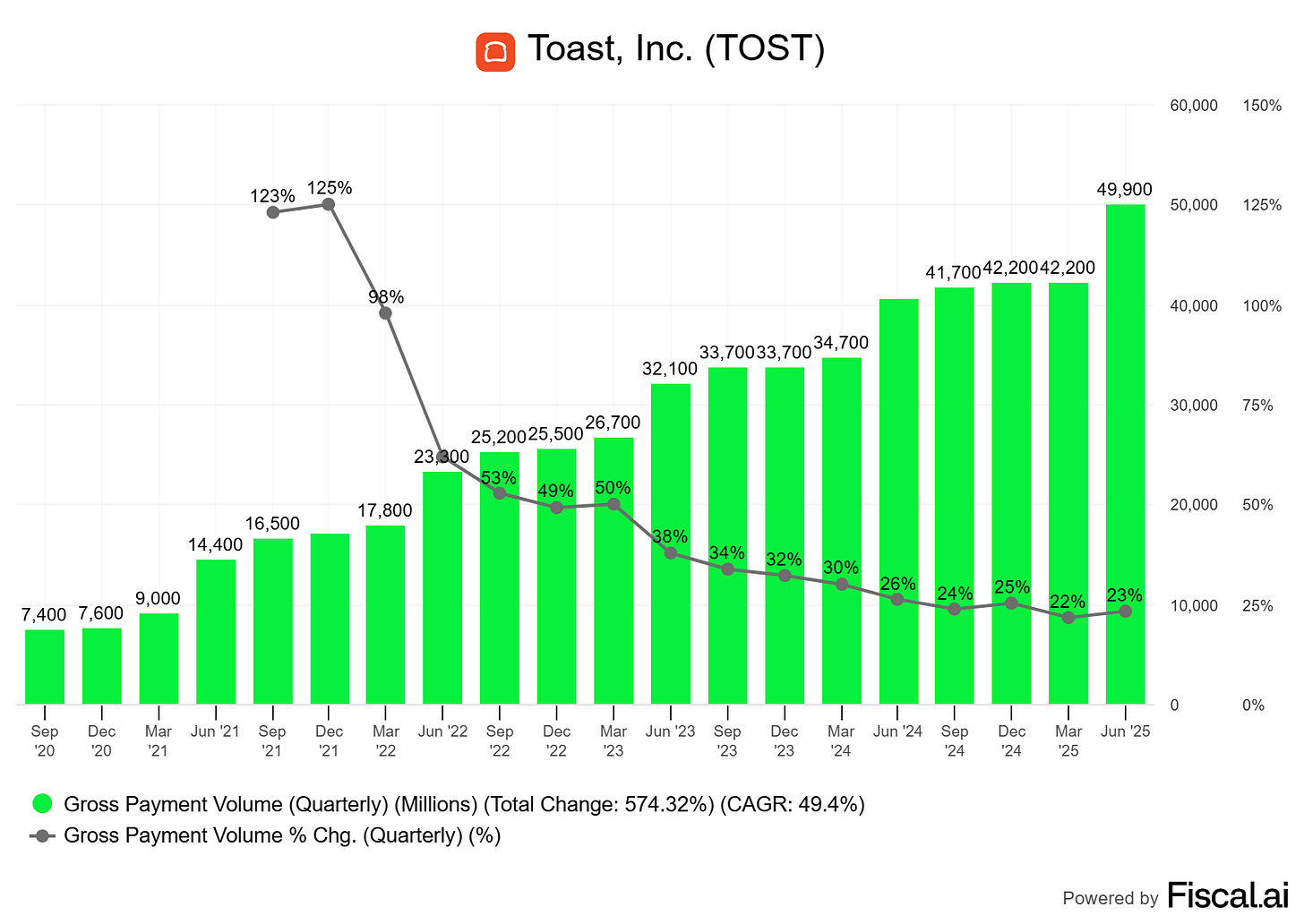

Gross Payment Volume (GPV): $49.9 billion for the quarter, up 23% YoY

Source: Fiscal.ai (affiliate link with a 15% discount for StockOpine readers)

Recurring Gross Profit (Non-GAAP): Grew 35% YoY in Q2 to $464 million

Adjusted EBITDA: $161 million in Q2 (10.4% of total revenue and 35% of recurring gross profit)

GAAP Net Income: $80 million in Q2 (5.2% of total revenue)

Source: Fiscal.ai (affiliate link with a 15% discount for StockOpine readers)

Outlook

Short-Term

Full-Year 2025 Non-GAAP Recurring Gross Profit Growth: 28% to 29%.

Full-Year 2025 Adjusted EBITDA: $565 million to $585 million. At the mid-point of 31.5% margin, it is over 5% above 2024 margin of 26.3% of recurring gross profit.

Q3 2025 Non-GAAP Recurring Gross Profit Growth: 23% to 26%.

Q3 2025 Adjusted EBITDA: $140 million to $150 million.

Location Growth: Management expects total net location additions in 2025 to surpass the record 28,000 added in 2024.

Long-Term (set on the Investor Day 2024)

Recurring Gross Profit Growth (Mid-Term): At least 20%+ annually for the 2-3 years following 2024.

Adjusted EBITDA Margin (as a % of Recurring Gross Profit):

Mid-Term Target (2-3 years): 30% to 35%.

The company has already reached this target in 2025, well ahead of the original 2-3 year timeline.

Long-Term Target: 40%+.

With that, we are ready to move into the valuation workings.